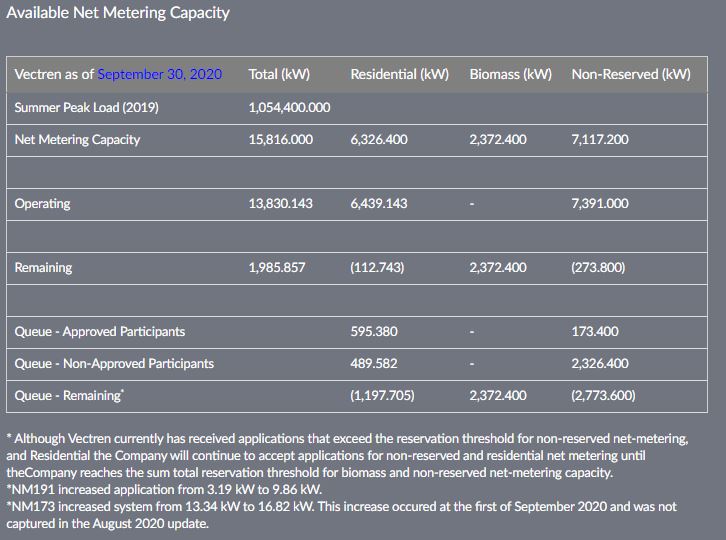

Here are the responses filed on December 8, 2020, by Vectren and the Indiana Utility Regulatory Commission (IURC) to the appeal filed by Solarize Indiana (SI) in the Indiana Court of Appeals on September 22, 2020.

Please see http://www.indianadg.net/solarize-indiana-appeal-of-vectren-30-day-filings/

From Vectren's Brief:

ARGUMENT

I. Standard of Review

II. The Commission correctly determined that Solarize’s

Objection, which alleged no particular violation of state or

federal law, did not comply with 170 I.A.C. 1-6-7, and raising

new arguments in the Reply was not permissible under the 30-

Day Filing Rule

A. Solarize’s Objection did not allege a specific PURPA

violation or other violation of “applicable law”

B. Solarize’s Reply, even if permissible under the 30-Day

Filing Rule, inappropriately raised new arguments,

which the Commission ultimately considered anyway

III. Solarize failed to exhaust available administrative remedies

IV. Neither the Annual Rate CSP Update nor the Net Generation

Contract violates PURPA and Solarize’s broad concerns are

better addressed in other proceedings

A. The Commission’s General Counsel correctly determined

Vectren’s Annual Rate CSP Update complied with 170

I.A.C. 4-4.1-1 et seq.

B. The Commission’s General Counsel correctly found

Solarize’s claims that the Net Generation Contract

violated PURPA were “without foundation”

Vectren’s Appellee’s Brief

Simply put, there is no reason for the same issues to be considered in multiple proceedings. If Solarize does not believe its arguments regarding these same PURPA issues will be appropriately or thoroughly considered in Vectren’s Rate EDG proceeding, it can initiate a complaint or investigation proceeding under Ind. Code §

8-1-2-34.5 or Ind. Code § 8-1-2-54. Given Solarize’s failure to exhaust available administrative remedies before the Commission, the multiple other regulatory avenues available to Solarize to seek Commission review and consideration of the very technical PURPA issues raised in its Reply, this Court should affirm the Commission’s lawful Order approving Vectren’s 30-day filings.

CONCLUSION

For all the foregoing reasons, the Commission’s Order should be affirmed.

43Y9448 - Vectren Brief of Appellee Download and read the brief.

IURC's Brief

ARGUMENT

I. Indiana’s implementation of PURPA has already been established

A. The standard of review requires the Court to defer to the Commission’s expertise and reasonable interpretation of its own rules

B. Rule 4.1 is the implementation of PURPA in Indiana

C. Solarize is seeking to force litigation regarding policy matters that have already been decided by the Indiana General Assembly

II. The Commission appropriately decided to reject the objections and approve Vectren’s filings

A. The objections did not comply with the 30-Day Filing Rule

B. Solarize’s PURPA arguments are factually and legally mistaken

CONCLUSION

For the foregoing reasons, the Court should affirm the Commission’s order.

43Y9288 - IURC Brief of Appellee (Solarize) FINAL Download and read the brief.

IndianaDG will update further actions.