A Virtual Power Purchase Agreement, or vPPA, can be a powerful tool for a company to meet aggressive environmental goals quickly and efficiently. However, a vPPA is a complex financial instrument and is accompanied by risks that quickly become traps for the unwary.

TAKEAWAYS

- A vPPA supports the growth of new renewable resources on the grid but is purely a financial instrument and not a contract for the purchase of electricity.

- Corporate buyers of all sizes across a wide range of industries can utilize vPPAs to advance environmental and sustainability goals.

- vPPAs may be green, but you don't want to end up in the red: managing market and operational risks and understanding the regulatory and accounting implications is critical to ensuring a vPPA supports financial, as well as environmental, objectives.

Virtual Power Purchase Agreements, or vPPAs, are no longer a rarity confined to Silicon Valley technology companies like Microsoft and Google. Just five years ago, technology companies accounted for well over half of all vPPAs. By the middle of 2018, technology companies accounted for only a quarter of vPPAs and had been joined by an ever-increasing number of companies in the consumer goods, financial services, healthcare, industrial and telecommunications sectors. In just the last six months of 2019, vPPAs were entered into by companies in a range of sectors, including Estée Lauder, McDonalds, Clorox, Walmart, Honda, AT&T, Sprint and the Gap, to name just a few.

So, what the heck is a vPPA?

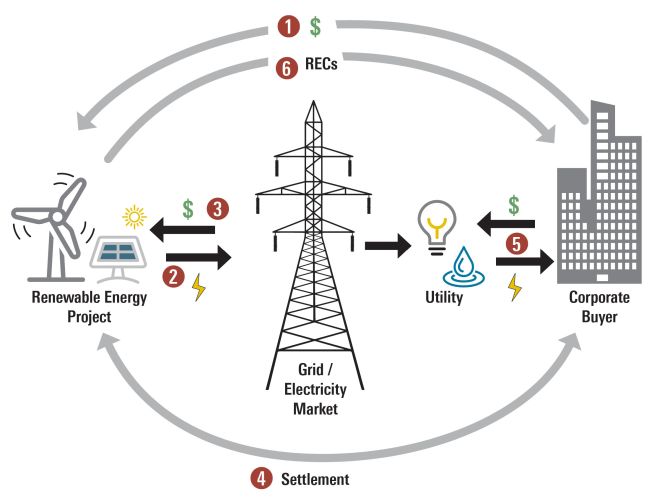

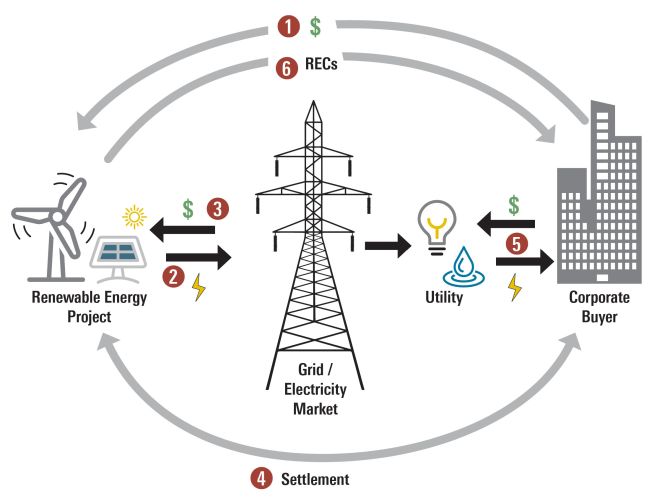

First and foremost, it is not a contract to buy electricity. Instead, it is (1) a contract for the purchase of environmental attributes, known in the U.S. as renewable energy certificates (RECs), and (2) a type of hedge instrument, also known as a contract for differences. The corporate buyer agrees to purchase a renewable project's power output and RECs at a set price, but the power is not physically delivered to the corporate buyer. Instead, the project company that owns the renewable project delivers the energy into the grid and sells it in the wholesale market at real-time or day-ahead prices. If the wholesale market price is more than the fixed price, the corporate buyer is entitled to that upside. If the wholesale market price is less than the fixed price, the corporate buyer is liable for that downside. The project company and the corporate buyer settle the cumulative differences between the fixed price and the wholesale market price either monthly or quarterly. The corporate buyer has a separate contract with its utility or other retailer to actually supply the power that serves its load. The corporate buyer can then sell the RECs or retire and use them in support of its environmental and sustainability claims.

- Corporate buyer and project company enter into vPPA for a fixed price.

- Electricity produced by project delivered into grid.

- Project company receives wholesale market price.

- Corporate buyer and project company settle the difference between fixed price and wholesale market price.

- Corporate buyer maintains its regular relationship with utility or other retail provider.

- Corporate buyer receives RECs and either sells or retires them.

Is a vPPA right for your company?

Consider the following questions:

- Does your company have environmental stewardship targets and goals that you have not yet met?

- Does your company lack the space or land needed to build your own renewable energy resources on site?

- Does you company prefer to avoid the upfront costs and time necessary to develop, construct, own and operate a renewable energy facility?

- Is your energy consumption highly distributed or do you have insufficient demand at an individual site for onsite generation to be commercially attractive?

- Does your current utility not offer green tariffs or other renewable power and REC purchase options?

- Are you located in a regulated market that does not allow or provide good incentives for direct purchase of green power?

If the answer to any (or all) of these questions is yes, then a vPPA might be a good option for your company. However, there are a number of considerations to keep in mind.

Location, location, location...

Unlike a physical PPA, because the energy does not need to be physically delivered, vPPAs are not inherently location-specific. This attribute may be attractive to companies that have highly distributed loads. It may also be attractive to companies that have significant load in regulated markets where there is not a viable or attractive option to procure green power and meet their renewable energy goals. It also allows companies to meet their renewable energy goals more quickly and efficiently than does a traditional PPA. The vPPAs entered into by McDonald's and the Gap provide two good examples of this. By entering into a 90 megawatt (MW) vPPA for wind power from the Aurora Wind Project in North Dakota, Gap was able to purchase the equivalent to the energy needs of over 1,500 of its retail stores, most of which are located at leased sites where onsite generation was not feasible. Similarly, McDonald's was able to purchase 380MW of clean energy from the Aviator Wind West Project and a solar project in Texas, which combined is the equivalent to over 2,500 restaurants-worth of electricity.

Like a physical PPA, a vPPA puts clean energy into the grid, and the corporate buyer owns all of the associated RECs. This creates a direct link between corporate actions and new renewable energy generation. That aspect may be sufficient for some companies, but for many companies it is important that the environmental benefits are physically in the same region as the company's operations.

In addition, the projects themselves do need to be within a liquid wholesale market so the project company can sell directly into the grid. The economics of the vPPA will turn on the difference between the floating wholesale price and the fixed vPPA price. Consequently, a wholesale market in which the floating price is both uniform and transparent is critical to creating a reliable dynamic for the financial settlement.

Managing market risks

Because a vPPA exchanges a fixed price for a floating wholesale market price, a corporate buyer is exposed to a large degree of market price risk. A sustained price differential between the vPPA price and the wholesale market price can result in literally millions of dollars of exposure, both positive and negative, for a corporate buyer. This risk can be mitigated in a few different ways.

The first is referred to as correlation, which means that the movements in the wholesale market price and the corporate buyer's own utility prices are closely aligned. If the floating wholesale price received by the project company and the corporate buyer's own electricity costs are closely correlated, then the vPPA will act as an effective long-term hedge against fluctuations in the utility prices. If the renewable project is in the same wholesale market as the corporate buyer, there will be a stronger degree of correlation. Another factor that may impact the degree of correlation is whether there is a price differential between when the renewable project is likely to be generating the most electricity versus when the corporate buyer's heaviest load will occur. vPPAs are typically settled on an hourly basis (and sometimes more frequently), so it is important to line up the power production of the renewable energy facility with the appropriate market price for the relevant calculation interval. For example, a wind project typically produces more of its output at night, when the energy prices are typically lower, whereas a corporate buyer's operations may use most of their load during the day when energy prices are higher. Energy price forecasting models and comprehensive financial analysis are helpful to analyze, quantify and assess the risk of taking a long position on the price of energy. This analysis can be complex, and the forecasting data required to make the best decisions is expensive, but the risks of getting this decision wrong can be equally costly.

Second, corporate buyers can contractually seek to mitigate market volatility risks by using tools such as minimum price limits, price floors or price collars. Utilizing these tools results in a higher minimum price in exchange for giving up potential downside if the price of energy goes below an agreed floor as well as potential profits if the price of energy goes above an agreed ceiling. In both cases, the corporate buyer will pay a slightly higher vPPA price up front, but the tradeoff is often worth it. Honda recently employed these structures when it entered into a 120 MW vPPA for wind power from the Boiling Springs Wind Farm in Oklahoma that included upper and lower bounds on Honda's exposure to price fluctuations in any given quarter.

Third, corporate buyers can seek to shorten the tenure of the vPPA. While early vPPAs had very long terms akin to traditional PPAs (20-25 years), the recent trend is for shorter tenures. It is now possible to secure 10- to 15-year terms. For example, Gap's vPPA mentioned above was for a 12-year tenure, as was the 70MW vPPA entered into by Clorox for solar energy generated by the 497 MW Roadrunner Project in Texas and the 173.3 MW vPPA entered into by Sprint for wind energy generated by the 182 MW Maryneal Windpower Project in Texas. These shorter tenures match many corporate buyers' procurement horizons more closely and also significantly de-risk the deal for the corporate buyer. Of course, this option will increase the upfront price because the shorter offtake term is less bankable for the project company.

Finally, corporate buyers may not have the demand or energy requirements to support an investment in a utility-scale project. Aggregated procurement is becoming more and more common over the last five years and allows corporate buyers the benefit of the economies of a large-scale utility project while only owning a smaller percentage of the financial commitment. A good example of this is the so-called Corporate Renewable Energy Aggregation Group, which was composed of five companies: Bloomberg, Cox Enterprises, Gap, Salesforce and Workday. Since 2017, these five companies collaborated together and culminated with the execution of a 42.5MW vPPA in early 2019 for energy produced by a North Carolina solar project. We are also seeing vPPAs for only a portion of a project's output; for example, the 22 MW vPPA that Estée Lauder entered into is equal to the output of approximately 10 of the 100 wind turbines to be installed at the 200MW Ponderosa Wind Farm.

Managing operational risks

While the corporate buyer is not taking physical delivery of the plant, it would be a mistake to underestimate the importance of appropriately allocating the operational risks. The project company should bear the responsibility of keeping the plant running on a day-to-day basis, as the corporate buyer will not want to share this risk. This goal is accomplished in the same way as in a traditional PPA, namely, by including an availability guarantee to ensure that the project will deliver as promised. The availability guarantee is a very heavily negotiated provision in the document and frequently contains numerous exceptions, including for curtailment, substation failure, equipment defects and maintenance outages. The project company should also bear the responsibility for delivering the power into the grid, which can result in additional transmission or distribution costs as a result of congestion pricing or curtailment. Early vPPAs varied in their delivery point—ranging from the busbar at the project to the regional market hub. Today, savvy corporate buyers will seek to shift as much of this risk onto the project company as possible and are frequently willing to pay a slight premium in order to settle the contract at the regional market hub.

Allocating regulatory burdens

Because vPPAs do not involve the physical delivery of power, many companies think the regulatory burden will be lighter. That is likely true because the company does not need to obtain power marketing authority from the Federal Energy Regulatory Commission or contract with an energy management services company or licensed power marketer to facilitate the delivery of physical energy. However, a vPPA is a swap agreement and therefore is subject to the Dodd-Frank Wall Street Reform and Consumer Protection Act. This status means that there are reporting, recordkeeping and registration requirements. Specifically, the parties to the vPPA are required to report on the terms of the swap, report post-execution amendments and file quarterly reports to Commodity Futures Trading Commission designated entities. For some corporate buyers that already have businesses subject to Dodd-Frank reporting, this burden can likely be easily managed. For others, however, responsibility for these reporting obligations can be allocated to the renewable project company under the vPPA. In addition, both the corporate buyer and the project company have to maintain records of the swap transactions indefinitely.

Understanding the accounting treatment

Because vPPAs are swaps, companies should carefully consider the accounting implications. There are now well-understood ways to manage the risk of mark-to-market accounting treatment through deal structuring and specific vPPA treatment. As noted above, the vPPA should include an availability guarantee (e.g., the project will be available to produce electricity 90 percent of the time). If the vPPA includes an output guarantee (e.g., the project will produce at least 200MW of electricity), then mark-to-market derivative accounting treatment will likely be required. Thankfully, there is now sufficient deal volume that accounting firms are regularly advising on these issues.

Conclusion

Companies across a wide range of industries are being held accountable not only by regulators, but also by their customers and investors, to meet aggressive renewable energy targets. Determining which tools are best suited to advance a company's renewable energy and sustainability goals is a detailed exercise that involves the weighing of a number of different factors. vPPAs can be a powerful accelerator to achieving those goals, but they necessarily come with risks that must be carefully understood and allocated. In recent years, we have seen larger organizations enter into these agreements, but as more pressure is put on all companies to advance ever more aggressive sustainability targets, we expect businesses of all sizes to begin utilizing vPPAs, either independently or as part of a consortium with other buyers.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Ms Alicia M. McKnight

Pillsbury Winthrop Shaw Pittman LLP

31 West 52nd Street

New York

NY 10019-6131

UNITED STATES