Shelby County BZA OKs 199-megawatt solar facility on nearly 1,800 acres of farmland |

| Jeff Brown, Shelbyville News Editor

At 11:08 p.m. Tuesday, the landscape of northeastern Shelby County changed.By a vote of 3-2, the Shelby County Board of Zoning Appeals approved a special variance request from Ranger Power to build a 199-megawatt solar facility on nearly 1,800 acres of farmland southeast of Morristown. “Tonight’s decision is a big decision that allows us to move forward with the project. It’s not the final decision that we need and there is lots more work to do – and we look forward to doing that,” said Pete Endres, development manager for Ranger Power. “Tonight, we won the opportunity to continue to work on it.” The favorable decision came nearly four months after the board voted 3-2 against Ranger Power’s first special variance request. The 4-plus-hour meeting Tuesday at Breck Auditorium at Shelbyville High School kicked off with an hour-long presentation of Ranger Power’s proposed project by local attorney Lee McNeely, representing the New York-based company. The $175 million project needed to satisfy five requirements set forth by the Shelby County Council in a Unified Development Ordinance regarding solar power facilities. McNeely carefully explained how the project is consistent with the Shelby County Comprehensive Plan, how it will not be injurious to public health and safety, how it will work in harmony with adjacent land uses, how it will not alter the character of the district and how it will not impact property values of the area. Once the presentation was complete, lawyers representing several opponents of the project countered Ranger Power’s information leaving the 5-member board to determine if a burden of proof was met. The meeting was then open to public commentary where 19 men and women of all ages stepped to the microphone to voice their concerns or express their interest in the project. Finally, the board asked questions directly of Endres and Aaron Svedlow of D.E. Shaw Group, a global investment and technology firm that is working with Speedway Solar, the official company name associated with this project. At 11:08 p.m., board president Kevin Carson called for a vote. Carson and Jim Douglas both voted “No” to the special request variance needed to put solar panels on farm land, as they did in November, while Rachael Ackley and Doug Warnecke voted “Yes,” again as they did in November. Dave Klene, who recently replaced Ann Sipes on the board, also voted “Yes.” Sipes voted “No” in the first meeting. “I’m sticking with the idea of the comprehensive plan,” said Carson. “The comprehensive plan of Shelby County says ... and many, many people put time into that and came to the community meetings ... and the overwhelming majority said we like the rural, agricultural integrity of Shelby County. And so, that’s where a lot of my basis goes toward in the Findings of Facts. I believe it went against the comprehensive plan.” Carson explained that agriculture was more harmonious that solar panels to the region. And he couldn’t really decide whether property values would be affected either way by the development. The project is slated to take up 1,791 acres in Union and Hanover townships in northeastern Shelby County. Over 700,000 solar panels will cover 1,015 acres with fencing and landscaping to protect the panels and limit their viewability, which concerns many neighbors of the project. “Hopefully what we demonstrated tonight is we’re going be a partner in this community for a long time,” said Endres. “Land owners who have chosen to participate in this project, that’s their decision and we respect that. And the decision tonight by the board respects their rights. But there are also other agreements we made tonight and will continue to make to protect Shelby County. We firmly believe this is a good project for the county.” Ranger Power also received a variance request Tuesday from the board to push back construction commencement to a 4-year window. Endres expects construction to start in 2022 with the facility up and running in 2023 to start servicing a 35-year deal to supply the energy created to Wabash Valley Power, an Indianapolis-based transmission cooperative. “There is a lot more developmental work to do in terms of surveys and design and engineering on the project. We still have some local processes that we need to go through too,” said Endres. “Next week we will be in front of the County Council for our tax abatement proposal and then down the road be back meeting with the technical advisory committee and the drainage board.” The arguments for and against the project amongst land owners in the area has been passionate. That has come as no surprise to Endres, who respects the opinions of those not in favor of this project. “I understand that some people just simply don’t want it but hopefully we’ve presented enough evidence to demonstrate that this is not a risk to them,” he said. “It’s a good thing for the people that have chosen to participate in it and the community more broadly, and we look forward to being a good partner going forward.” |

Author Archives Laura Arnold

The Hunt for the Value of Distributed Solar

The Hunt for the Value of Distributed Solar

A new ICF study shines light on net energy metering and solar valuation efforts across the United States.

Finding the value of distributed solar has led state regulators and utilities into unknown territory. States across the country have undertaken studies to determine the locational value of additional solar resources, but there’s no clear consensus on the best way forward.

Our meta-analysis for the Department of Energy, “Review of Recent Cost-Benefit Studies Related to Net Metering and Distributed Solar,” takes an in-depth look at recent efforts in 15 states. Together the studies demonstrate an evolution of diverse approaches for assessing the costs and benefits of distributed solar.

Table 1. Studies Analyzed

What’s new in studying the value of solar?

Not much has changed since earlier comparisons of solar cost-benefit studies. ICF and other organizations have conducted similar reviews in the last five to 10 years and many of the same variables continue to cause studies to draw conflicting conclusions about the net benefits of solar and how they should be applied to compensate customers who sell/inject their solar power back onto the grid.

Among the most significant drivers for disparate results are choices about which costs and benefits (i.e., value categories) to include and monetize in a study. Another big influencer is the perspective taken by the research—whether to examine value categories from the view of customers, the utility, the grid, or society at large.

One apparent trend is a clear shift away from net metering policies (NEM) toward NEM successor tariffs and broader technology-neutral frameworks, including the value of distributed energy resources (DER) beyond solar. This change enables stakeholders to better align compensation for DER with the value they create.

Two examples from the meta-analysis exhibiting this shift are New York’s BCA Framework and Value of DER (VDER) methodology and frameworks currently undergoing refinement based on California’s Locational Net Benefit Analysis (LNBA), while additional efforts in Hawaii, Michigan, and a number of other states show similar changes.

Can valuation become more standardized in the future?

All signs point to more standardization in the future. However, of the value categories common across two or more of the studies (see Table 2), only three components—all on the bulk power system—were included in every single study: avoided energy generation, avoided generation capacity, and avoided transmission capacity.

More complex value components, such as those on the distribution system, are challenging to standardize and are thus incorporated in fewer studies. Most studies took the first step, starting with avoided distribution capacity because it is one of the largest and most readily quantifiable distribution-level values, although it also raises the significant question of rate differentiation amongst consumers.

As a second step, stakeholders can work toward including the additional value of increasingly complex components such as resilience and reliability, voltage and power quality, and avoided operations and maintenance costs. A few studies mentioned these values but did not venture to quantify them.

Table 2. Summary of value categories used in studies

Further standardization could help improve distributed solar valuation practices, especially across the cost-benefit categories. Because the distribution grid and retail service are regulated at the individual state level and valuation of distribution (D) is an inherently location-specific activity, it’s no surprise that a common valuation framework has not emerged. However, a set of standard elements with agreed-upon definitions and common value categories could offer a shared starting point and allow for variables that account for changing factors. In New York, for example, a recent proposal by regulatory staff to eliminate the Locational System Relief Value, which applied to specific locations, in favor of a Distribution Relief Value, which applies to entire distribution systems, shows how challenging it can be to achieve consensus and how states may look toward more standardized approaches as solutions.

Several stakeholders have called for a national framework and efforts are now underway to develop a standard model to address other DERs, based on extending the cost-effectiveness principles used to assess energy efficiency in the National Standard Practice Manual.

Which valuation framework is best?

Selecting the right valuation framework ultimately comes down to state-specific policy goals and local grid needs. Currently, it is difficult for regulators, utilities, and other stakeholders to select a model because of the quantity and diversity of available options.

New approaches to more accurately assess the costs and benefits of deploying DERs on the electricity system are still rapidly developing and best practices. Our comprehensive assessment shows the commonalities and differences of how the latest efforts across the country apply these concepts and affirms that the quantification of locational value is continuing to evolve.

NIPSCO wants to entice large customers to stay; will smaller ones pay the price?

The ArcelorMittal Steel Mill in Indiana Harbor is one of the five large industrial NIPSCO customers that would be affected by a cost shift proposed by the Indiana utility.

Indiana utility wants to entice large customers to stay; will smaller ones pay the price?

NIPSCO wants to greatly reduce what its five largest customers pay for power while increasing residential fees.

The Northern Indiana Public Service Company (NIPSCO) plans to close two coal-fired power plants, R.M. Schahfer in Wheatfield andMichigan City in Northwest Indiana, within a decade.

Clean energy advocates have largely applauded the utility’s decision, which will mean cleaner air and ratepayer savings of about $4 billion, according to the company. A related move by the company is drawing criticism, though.

NIPSCO is proposing to greatly decrease the amount paid by its five largest customers — including steel mills and an oil refinery — in a bid to dissuade them from developing their own generation and curbing their reliance on NIPSCO.

In a rate case currently before the state’s Public Utility Commission, NIPSCO proposes to significantly reduce the amount these large industrial customers pay for fixed costs including upkeep of the grid and depreciation costs associated with the coal plants’ closing. That means more of the burden will fall on regular customers and smaller businesses.

In expert testimony filed for the Citizens Action Coalition, consultant Jonathan Wallach said the large industrials would see their fixed costs drop by about 60 percent thanks to the new structure. In all, $67 million to $80 million worth of the utility’s cost recovery would be shifted from large industrial to smaller customers, estimated Wallach, vice president of Massachusetts-based Resource Insight, Inc. NIPSCO itself estimated that $40 million worth of costs would be shifted.

Coalition Executive Director Kerwin Olson said he finds the request to reduce large customers’ fixed costs ironic, since NIPSCO like otherutilities has argued that customers reducing their energy demand through distributed solar are not paying their fair share to keep up the grid. As Olson sees it, the cost shift would mean the large industrial customers would not be doing their part for grid upkeep.

“We want to do what we can to support NIPSCO’s clean energy transition,” Olson said. “We didn’t say no cost shift; we basically said it’s not fair the industrials aren’t paying their fair share, and it’s not fair every other rate class gets an increase and industrials get a decrease. We’re trying to find a middle ground.”

Fleeing the system?

The BP Whiting oil refinery in Northwest Indiana a decade agobought its own natural gas combined cycle co-generation plant, capable of generating 525 megawatts by reusing waste heat.

“If the other large industrial customers were to follow suit and generate their own energy, it would mean that nearly all of their costs would need to be spread among all other remaining customers — including both commercial and residential,” said NIPSCO spokesperson Nick Meyer.

“Instead of this potential future scenario, NIPSCO has proposed a rate structure that maintains industrial competitiveness, keeping these employers and their jobs in northwest Indiana, and keeping a portion of their usage tied to NIPSCO’s system as a way to help reduce the cost burden on all other customers.”

Meyer said the five large industrial customers that would be affected by the proposed cost shift are BP along with steel operations US Steel Gary Works, ArcelorMittal and NLMK, and industrial gases company Praxair.

“NIPSCO’s five largest industrial customers have historically accounted for approximately 40 percent of NIPSCO’s energy sales and have covered a significant portion of the overall fixed costs associated with producing and delivering electricity to nearly half a million customers,” Meyer said. “They face global competition and it’s imperative that they’re not paying for more of the system costs than what is tied to serving them.”

Olson said the utility is offering the industrial customers a deal that is unfairly sweet.

“What they’re effectively doing is giving those industrial customers a deregulated marketplace,” he said.

“This is classic deregulation stuff — industrials leave the grid to procure their own energy yet don’t have to contribute to the ongoing costs of assets — power plants — that were put into place to serve them. They shouldn’t just be able to say, ‘We’re not paying for that anymore, we’re doing our own thing.’ It’s like having a mortgage on a house — you move out of your house and the mortgage isn’t paid, you still have to pay that mortgage.”

Fixed cost increase

Under NIPSCO’s proposal, residents would also face a monthly fixed cost increase from about $14 to $17. Citizens Action Coalition is proposing the cost be lowered to $12.55 per month.

“If usage-driven costs are inappropriately collected through fixed customer charges, then customers will have reduced incentives to control their bills through conservation or investments in energy efficiency or distributed renewable generation,” Wallach testified.

Meyer indicated that the increase might entail switching payments from another part of the bill into the fixed cost charge, giving customers “a clearer picture of how energy use affects their bill.”

“Additionally, increasing the customer charge further stabilizes customer bills throughout the year, especially during the summer, when electric bills are typically higher because of warmer temperatures and increased usage,” she said.

Low-income help

The coalition also filed expert testimony from John Howat, a senior policy analyst at the National Consumer Law Center, calling for more programs to help low-income customers. He wrote that the federal Low Income Home Energy Assistance Program is not adequate as evidenced by the fact that between 2013 and 2018, up to a third of residents with the aid had their electricity disconnected.

Howat estimated that given the cost of living, one would need to earn almost double the poverty-level wage to live in NIPSCO service territory. More than a quarter of families are not earning that much, he testified, and “low-income households must devote a higher proportion of total household income to basic home electricity service than their higher-income counterparts.”

A full-time worker earning minimum wage would spend 7.5 percent of their wages on electricity, Howat reported, while a household making over $100,000 would spend only 1.2 percent of their income on electricity.

“We’re not talking about video games, we’re talking about electricity to heat and cool your home and take a hot shower,” Olson said. “Just simply put, access to electricity in one’s home is a necessary and essential human service, in order for folks to participate in society in a meaningful way.”

IndianaDG Note: The IURC held a public field hearing on the NIPSCO proposed rate increase on 3/11/19.

The Office of the Utility Consumer Counselor (OUCC ) invites written consumer comments through the close of business on Wednesday, March 13, 2019.

City leaders, families oppose NIPSCO rate hikes

Lauren Cross,

HAMMOND — About 200 people — including seniors, elected officials and families living paycheck to paycheck — poured into the Hammond High School’s auditorium Monday night to sound off against NIPSCO’s proposed rate hikes.

The meeting was held so that the Indiana Utility Regulatory Commission, which must approve any rate increase, could hear testimony from the public as part of its legal proceedings over NIPSCO’s rate case.

Under the utility's plan, the average monthly bill for small businesses and residential customers would increase by nearly 12 percent, whereas industrial customers’ bills would be reduced by nearly 19 percent.

The overall bill adjustment includes an increase to the existing, fixed $14 monthly customer charge by $3 per month, according to NIPSCO, which services about 820,000 natural gas and 460,000 electric customers.

People like Queen Alexander, a Lake County deputy clerk, said the hike means she and her husband’s $240 monthly utility bill at their Hammond home will increase by about $30 a month, or $360 per year, on top of NIPSCO’s proposed $3 monthly fixed charge increase.

“It’ll be like living paycheck to paycheck,” she said. Her husband, retired from the steel mills, now brings home a fixed income.

Buddie Fernie, of Hammond, said he retired in May from the city of Hammond’s planning department. Now 77, he and his wife live on a combined fixed income of about $52,000, he said.

“We can’t afford this. We recently had to remortage our home,” he told The Times.

Many argued it’s unfair that NIPSCO’s five biggest industrial customers — BP, U.S. Steel, Arcelor Mittal, Praxair and NLMK Steel – are all getting a break while the utility shifts the burden to individual consumers.

Wearing a navy blue T-shirt that read “Empower Indiana” and “People Over Polluters,” Lou Donkle, of Valparaiso, said the hike “reeks of yet another blast of trickle-down economics.”

“Give to the corporations and the rich, and take from the poor, the working class,” Donkle said.

People like Nancy Moldenhauer, of Michigan City, argued higher energy costs force low-income families to decide between paying their electricity bill and paying for other critical items such as health care, food and childcare.

“They have to make the choice of paying for food and medicine over having to keep warm in the wintertime and cool in the summer,” she said.

The changes would generate an additional $21.4 million in revenue, according to NIPSCO’s filings with the IURC. The average customer would see their bill increase by $11 per month, or about $132 per year.

NIPSCO has said the rate hikes are part of a larger plan to accelerate the retirement of older, less efficient coal-fired equipment and services and shift to natural gas and renewable sources.

Newly proposed electric rates would be phased in over two steps in September 2019 and March 2020, according to the company.

In recent days and weeks, several municipal boards, including Michigan City, Hammond and Gary, have passed resolutions opposing the hikes.

Municipalities would also be hit hard by the increase, officials argued.

Michigan City Council President Don Przybylinski said the city’s annual bill from NIPSCO is about $1 million. The company’s proposed increase would raise that by about $175,000, he said. He said small business owners with whom he has spoken to believes their bills will increase by about $5,000.

“That’s money that could be used to increase employee wages or benefits,” he said.

Gary City Councilwomen LaVetta Sparks-Wade, 3rd District, and Rebecca Wyatt, 1st District, spoke in opposition.

Sparks-Wade, a Gary mayoral candidate, said the city’s median income is $15,000.

“I plead of you, I beg of you, and I implore you not to give this increase to NIPSCO,” she told the IURC.

Wyatt said the cash-strapped city’s NIPSCO bill is about $370,000 a month. City government and its residents will suffer, while NIPSCO’s biggest industry customers benefit, she said.

“While businesses can pass on any increase, there’s no one, no one, for whom the family household can pass this onto,” she said.

NIPSCO has repeatedly pointed out their rates fall below the national average. However, the Indiana Office of Utility Consumer Counselor — the state's advocate for utility customers — said the utility’s electric rates ranked second-highest among utilities regulated by the IURC as of July 1, 2018.

The state’s OUCC is recommending against the hike.

This isn’t the first time NIPSCO’s proposed hikes has drawn the ire of residents, activists and business owners. More than 300 people turned out to IUN to an IURC hearing in March 2009, where the utility company was requesting a similar hike. That request was ultimately shot down in part due to public pressure.

NIPSCO spokesman Nick Meyers said hearing from consumers is an important part of the regulatory process.

“The goal of this nearly yearlong review is to strike a balance on new rates that are fair to both customers and the company,” he said.

Groups like the Sierra Club, the Indiana NAACP and Citizens Action Coalition have come out in opposition of the hike.

CAC explains why Indiana HB 1470-2019 is BAD

Background on House Bill 1470 (2019)

House Bill 1470 amends Senate Enrolled Act 560, which was signed into law by Governor Mike Pence on April 30, 2013. SEA560 created a new billing mechanism for the electric and gas investor-owned utilities known as the TDSIC tracker. TDSIC is an acronym for Transmission, Distribution, and Storage Improvement Charge.

The law allows the utilities to file at the Indiana Utility Regulatory Commission (“IURC”) for a 7-year TDSIC plan and, if approved by the IURC, collect 80% of the costs for the plan through the TDSIC tracker on customers’ monthly bills. The remaining 20% of the costs associated with the plan would be deferred for recovery in the utilities’ next base rate case. The law requires that the utility file a base rate case at the conclusion of the 7-year TDSIC plan.

The TDSIC tracker was described by proponents of SEA560, and defined in the law, as an incentive for electric and gas utilities, granting expedited cost recovery, including a rate of return, for 80% of the costs for projects that a public utility undertakes for purposes of safety, reliability, system modernization, or economic development, including the extension of gas service to rural areas (Indiana Code § 8-1-39-2). Notably, the utilities are already under this obligation - SEA560 merely provided utilities with less risk and easier access to customer money to do so.

WHY ARE WE HERE? WHY HB1470?

The TDSIC tracker has spent the better part of the last five years in the courts. The industrial customers have repeatedly challenged IURC approval of certain costs included in the TDSIC tracker. The industrial customers have argued that the utilities may only recover costs associated with specific projects designated in the TDSIC plan, and that the utilities should not be allowed to recover costs for “categories” of projects which were not specifically identified in the TDSIC plan. In other words, the utilities should not be allowed to charge customers through the TDSIC tracker for new projects which were not identified in the initial TDSIC plan and included in the costs of that plan, i.e. TDSIC is not a blank check for utilities to recover costs through a tracker, especially considering the fact that utilities can otherwise recover prudently incurred costs in base rate cases.

The NIPSCO Industrial customer group secured a significant win at the Indiana Supreme Court in June 2018, when the Court unanimously reversed a lower court ruling. The lower court had upheld the IURC approval of NIPSCO’s requested cost recovery for categories of projects under their existing 7-year TDSIC plan. In reversing this lower court ruling, the Indiana Supreme Court wrote:

We conclude the TDSIC Statute permits periodic rate increases only for specific projects a utility designates, and the Commission approves, in the threshold proceeding and not for multiple-unit projects using ascertainable planning criteria. In other words, a utility must specifically identify the projects or improvements at the outset in its seven-year plan and not in later proceedings involving periodic updates. There is an appreciable difference between designating specific ‘projects’ and ‘improvements’ up front, which the Statute requires, and describing the criteria for selecting them later, which the Commission approved (emphasis added).

NIPSCO then filed a motion for rehearing with the Indiana Supreme Court. After rehearing, the Court modified the unanimous decision on September 25th, 2018, and made a small, but significant, addition to the language of the unanimous opinion. The Court stated that while the TDSIC statute did not allow the utility to recover costs for new projects through the TDSIC tracker, the utilities could recover expenditures related to any cost overruns in the utilities’ next base rate case.Specifically, the Court added the bolded language below in the updated opinion:

After the Commission has approved the foundational seven-year plan under Section 10, the utility may file petitions every few months under Section 9 to obtain ‘automatic’ rate adjustments for approved costs and expenditures as it completes these improvements and puts them into service. I.C. §§ 8-1-39-9(a), (c), (e). These periodic Section 9 petitions allow the utility to recoup eighty percent of approved cost estimates. Id.§ 8-1-39-9(a). The remaining twenty percent — along with any cost overruns that are specifically justified by the utility and specifically approved by the Commission — is recoverable during the general ratemaking case required (emphasis added).

Clearly, NIPSCO and the other investor-owned utilities were not satisfied with the updated opinion, which leads us to HB1470.

WHAT DOES HB1470 DO?

1. HB1470 makes several significant changes to the original statute. Those changes are mostly in response to rulings made by the IURC and opinions written by the Indiana Courts.

As interpreted by the Indiana Supreme Court, the current law requires the utilities to specifically identify the projects within their 7-year TDSIC plan and limits the costs which the utilities may recover through the TDSIC tracker to the cost estimates associated with those specific projects. HB1470 changes that by amending the definition of eligible transmission, distribution, and storage system improvements (Indiana Code § 8-1-39-2), which can be included in the TDSIC tracker. HB1470 adds the following language to the definition of projects eligible to receive the TDSIC tracker (page 2, lines 6-9):

projects that do not include specific locations or an exact number of inspections, repairs, or replacements, including inspection-based projects such as pole or pipe inspection projects, and pole or pipe replacement projects (emphasis added).

Should HB1470 become law, the utilities would no longer need to specifically identify the projects they intend to complete in order to receive the favorable TDSIC tracker, effectively overturning the Indiana Supreme Court opinion.

In other words, even if the utilities have little to no idea what they are going to spend customer money on, they can provide merely a rough estimate of costs and still collect that money from customers through the TDSIC tracker. This new language reduces the utilities incentive to adequately plan for the future, and to properly manage their costs.

2. HB1470 goes a step further in amending the definition of eligible transmission, distribution, and storage system improvements. The bill also adds the following to the definition of projects eligible to receive the TDSIC tracker (page 2, lines 10-14):

projects involving advanced technology investments to support the modernization of a transmission, distribution, or storage system, such as advanced metering infrastructure, information technology systems, or distributed energy resource management systems (emphasis added).

Advanced metering infrastructure is more commonly referred to as smart meters. The IURC, and other state regulatory commissions, have denied trackers for smart meters and the related infrastructure, questioning the costs borne by customers when compared to the purported benefits received by customers. HB1470, should it become law, would mandate that the IURC allow smart meters to be included in the TDSIC tracker, regardless of whether or not the benefits to customers outweigh the costs.

3. HB1470 would allow the utilities to cancel an existing approved TDSIC plan and refile for approval of a new TDSIC plan. Currently, Duke has an approved electric TDSIC plan, and both NISPCO and Vectren have approved electric and gas TDSIC plans. Those five plans collectively total over $3 billion. Considering the new definitions of eligible projects, all of those existing plans could be withdrawn, and the utilities could file new, updated, and more expensive plans with the looser requirements applying to the new plans. Considering these proceedings are statutorily required to be finished within 210 days, this is an extraordinary ask of the IURC and customer parties.

4. HB1470 further reduces the authority and discretion of the IURC by amending only a few words in the existing law. While the law currently mandates that the IURC approve the TDSIC plan by stating the commissionSHALL approve the plan (Indiana Code § 8-1-39-10), it does provide some discretion to the IURC when approving TDSIC proposals by allowing the IURC to designate the eligible transmission, distribution, and storage improvements included in the plan as eligible (Indiana Code § 8-1-39-10) for the TDSIC tracker.

HB1470 removes that discretion by striking the language allowing the IURC to designate the eligible projects and replacing that language with the commission shall approve the plan AND AUTHORIZE TDSIC TREATMENT for the eligible transmission, distribution, and storage improvements included in the plan (page 4, lines 12-14).

CONCLUSION

When taken together, these four significant changes to the existing TDSIC law contained within HB1470 effectively turns the IURC into a rubber stamp by requiring approval of a TDSIC tracker, even if the IURC has previously rejected all or parts of a proposed plan, and even if the utility has little to no idea what their plan is and how they will spend customer money. In other words, the State of Indiana is giving the utilities a blank check and is rendering the IURC, our state agency with the expert and technical knowledge to fully understand the impact of these plans, virtually powerless to do anything about it.

The Supreme Court opinion says it all:

The stakes are much larger than just the roughly $20 million at issue between NIPSCO and the Industrial Group. The Commission, we are told, has approved billions of dollars of utility-infrastructure investments through the TDSIC process. Given the favorable regulatory treatment, utilities are likely to funnel increasing amounts of infrastructure investments through this reimbursement mechanism. How we resolve these competing visions of the TDSIC Statute will likely haveenormous financial consequences for utilities and their customers.(emphasis added)

There are billions of dollars at stake here. The legislature should hit the pause button on this legislation and, instead, undertake a comprehensive and inclusive dialogue with all stakeholders at the table to craft energy policy which is truly in the public interest. Encouraging and incentivizing the status quo will only lead to excessive utility profits and significant increases in the cost of energy. That may be in the best interest of the monopoly utilities, but it’s certainly not in the best interest of the public or the State of Indiana.

Here is a recent Twitter thread by Ben Inskeep about HB 1470:

- It’s time for a thread on under-the-radar legislation poised to pass in Indiana that is an exemplar of how utilities are gutting oversight and needlessly increasing customer bills in the name of Grid Modernization.

- Before we dig into the specifics, let’s review some important context. Energy utilities across the USA are getting worried because their electric sales are flattening or decreasing (thanks in large part to energy efficiency standards & programs the utilities have fought).

- Without increasing demand, the utilities can’t justify building large new power plants. And that is a problem for a monopoly utility, since its profit is based on earning a return on capital investments like big new power plants.

- Against the backdrop of anemic sales growth, utilities have shifted their tactic from building expensive power plants to proposing massive, unprecedented spending on the transmission & distribution (T&D) grid (i.e., poles, wires, and related tech).

- Utilities are now using plans for so-called “grid modernization” to bypass regulatory scrutiny & oversight, gold-plate investments, & shift the risk of investments from shareholders to ratepayers--possibly wasting billions of dollars & significantly increasing electric bills.

- See, utilities don’t want to spend a bunch of money on T&D without knowing exactly how and when they are going to recover those costs from captive ratepayers. They definitely don’t like nosey regulators asking too many questions about this spending, and possibly rejecting it.

- So utilities are going to the legislators (which they give big $$$ to) and asking them to change the laws. They don’t want to have to show their spending was reasonable, or resulted in benefits to customers, or was done in a well-thought-out manner using lowest-cost solutions.

- Instead, they want to raise rates on families and businesses to get their money back, plus a handsome profit, as quickly as possible, and they want to take away the power of independent regulators to tell them “no” for any bad investments they make.

- In Indiana, utilities have been able to do this via 7-year Transmission, Distribution and Storage Improvement Charge (TDSIC) plans, which allows utilities to immediately recover most T&D costs—plus a large profit—through an extra charge, or TDSIC “tracker,” on electric bills.

- Trackers virtually guarantee recovery of costs. They significantly reduce the utility’s risk of not being able to recover those costs in a future rate case. https://www.citact.org/energy-policy-utility-rates-and-regulation/news/utility-agenda-trackers …

- But...the Indiana Supreme Court recently ruled utilities can’t use the TDSIC tracker as a blank check. Rather, utilities must identify the *specific* T&D projects in their initial plan and follow that plan, rather than making up new ways to spend money as they go.

- Enter Indiana HB 1470 of 2019: http://iga.in.gov/legislative/2019/bills/house/1470 …. This bill would gut the few checks & balances that remain on the TDSIC tracker, giving utilities essentially unlimited power to increase customer electric bills, with very limited regulatory oversight. #INLegis

- Despite being poised to pass the legislature, this bill has seen absolutely no state, national, or industry media attention (as far as I know), and little attention by most advocates in Indiana, although @cacindiana is a clear exception: https://www.citact.org/indiana-general-assembly-indiana-bill-watch/2019-indiana-general-assembly/news/background-house-bill …

- This is not that surprising, since this is a really wonky topic and it would be nearly impossible for anyone not deeply familiar with Indiana energy/utility policy to understand the implications of this bill by just casually reading through its text.

- But while not unexpected, it’s still a travesty, since this is one of the most extreme bills in the nation in terms of rewriting utility regulation to give unprecedented hand-outs to utilities, raise consumer rates, and shift risk from utility shareholders to customers.

- Why is this bill so terrible? I’m glad you asked. Let’s shine a light on a couple of the more pernicious aspects of its provisions to identify why this a major departure from regulatory norms and epitomizes monopoly rent-seeking. (More info via CAC: https://www.citact.org/indiana-general-assembly-indiana-bill-watch/2019-indiana-general-assembly/news/background-house-bill …)

- First, the bill expands the TDSIC tracker to include projects where the utility knows it wants to spend a bunch of money to boost its earnings, but hasn’t done their homework to determine where or how many things it wants to install.

- Second, the bill expands the TDSIC tracker to include…basically every type of non-generation investment. The provision is so broad, it is hard to say what would *not* fall under its expansive umbrella.

- Note that it adds AMI to the TDSIC tracker – no more pesky regulatory scrutiny that had required utilities to show actual customer benefits from spending hundreds of millions of dollars on new meters. Now regulators *must* approve AMI, even if there are no benefits!

- Third, the bill allows utilities to cancel their existing TDSIC plans and file even more expensive plans that have even less regulatory oversight. TDSIC plans already account for BILLIONS in utility spending. How much more will our rates increase under these plans? Who knows!

- Fourth, the bill removes the ability of regulators to approve only some of the utility’s proposed projects; instead, the regulator must approve all—or none—of the utility’s billions in proposed spending. No more regulator flexibility or discretion to remove wasteful projects!

- By law, regulators only have 210 days to review and approve a utility’s TDSIC plan that could have hundreds of proposed projects totaling billions in investment. It’s hard to conduct any meaningful review or oversight in such a short time period.

- Moreover, bill mechanisms like trackers and riders are TERRIBLE policy for cost recovery of T&D spending. Its a massive shift in risk for unprecedented utility spending from their shareholders to families & businesses, since it practically guarantees immediate cost recovery.

- The bill also guts requirements that utilities plan wisely for the future on behalf of their customers. Instead, it gives a blank check to utilities to spend as much as they want, whenever they want, in an ad-hoc fashion with almost no oversight.

- Side note: utilities have used the TDSIC to sneak in extra #fixedcharges on customers. Here's Vectren's TDSIC, which added $1.50/month to its fixed charge:

- Policymakers should be protecting CONSUMERS, and not do the bidding of utilities by undermining transparency & oversight of utility spending to benefit utility SHAREHOLDERS. While this thread has an Indiana focus, utilities are pushing hard for similar plans across the USA.

- We can’t conflate the real need for certain grid modernization investments with policies that rubber-stamp unlimited utility spending on unspecified and poorly planned projects. And we shouldn’t gut the regulatory oversight needed to protect ratepayers from big bill increases.

- I fear we are now headed towards a new era of utility boondoggles, in which excessive spending is on T&D “grid modernization” projects that provide little if any benefit. These won’t get as much attention as the boondoggle power plants of the past, but could be just as costly

Council approves 1st step for Indiana solar farm abatement

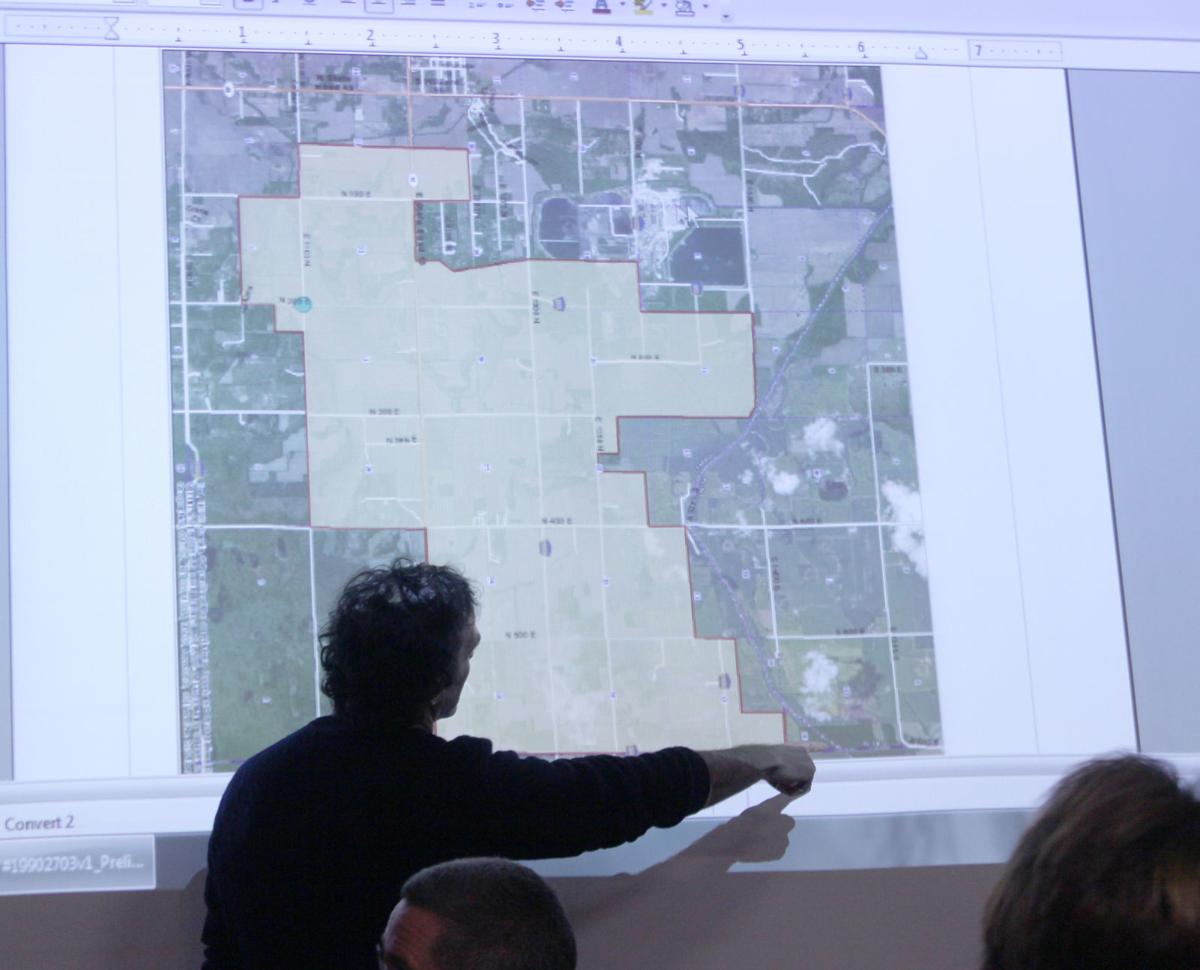

Photo by CHERI SHELHART

Justin Wolf, project designer for Orion Renewable Energy, explains the area the company is asking to be designated an “economic redevelopment area” or ERA, an area of approximately 2,200 acres, as the first step to a tax abatement request. The map is sideways, with north facing east, etc.

RENSSELAER — On Tuesday night, the county council approved the first step towards a tax abatement for a proposed large solar farm to be located in Kankakee Township, south of the NIPSCO plant. Orion Renewable Energy Group, LLC., was represented by project designer, Justin Wolf, who had appeared before the council in December to discuss the company’s plans.

Wolf brought with him a preliminary resolution for the council that designates the area Orion Renewable plans to use to build the solar energy panels as an “economic redevelopment area.” He plans to come back to the council in March with a proposal for a tax abatement, which the council will consider at that time. The board was given two scenarios for an abatement using a $100 million example for either a sliding abatement that would gradually increase the property tax on the company or a complete abatement for a span of 10 years.

Umbaugh & Associates, an Indianapolis based CPA firm used by many municipalities to research and do studies on costs analyses for different projects, was hired by Orion Renewables to study the impact of a tax abatement to the county and the company. Matt Eckerle, with Umbaugh, explained their analysis was done without consideration to anything else going on in the county and the township, including the closure of the NIPSCO coal burning generating plant in Wheatfield. Orion Renewables is actually looking at a $300 million project, so all of the numbers could be multiplied by three.

The estimated savings to the company for the sliding abatement would be $1.9 million while the 10 year zero payment abatement would save the company over $3 million. The benefit to the county would be an economic development payment of $30,000 over 10 years or $20,000 over a period of 20 years.

Wolf said with the 100 percent abatement over 10 years, the company would “carve off” half of the savings and redirect it back to the county to use as they see fit. “Orion doesn’t have a preference either way,” he said. “It’s just something to think about.”

He explained he has been working on this project for three years, and this is the culmination of his efforts. He said the company has been working with land owners in the area to partner with them for the project. Most of the land is leased, he said, and others are waiting for the county council’s decision before signing. Orion will build a substation first, sometime in fall or winter, then he said it’s like an assembly line for construction with one crew putting in one part of the solar panel construction, followed by another with the construction taking about six months, start to finish. Currently, the company has sent an request to NIPSCO to buy the energy produced by the solar panels, and sending the power through the transfer station at the Schahfer plant, which will be close to the planned solar fields.

Right now, Wolf said, NIPSCO is focusing on wind energy before turning their attention to solar. He expects they will be ready to consider solar before the expected final shutdown of the coal burning operation in 2023. “We are well positioned to respond to them,” he said when NIPSCO turns their focus to solar. He said NIPSCO will look at companies that are shovel ready and they would be from turning dirt to being operational within six months.

Rein Bontreger, council president, said they had been asked to not only look at local employment possibilities with this abatement request, but to look at the landowners instead. He asked how this would benefit them. Wold said there will be about 30 landowners when it’s all done, and there is a lot of sand in this area where farming can be a challenge. He said he has heard this from the landowners. There will be significant income generated in the area relative to where it was before, he said. He added this will be built in Kankakee Township, which will be hardest hit when the NIPSCO plant closes.

He said by bringing in this renewable energy, it would be a strong attraction for other companies looking to locate in an area that has this “green” energy. He said it is also important for millenials who could make this county a bedroom community for Chicago and for retirees.

The biggest beneficiary to the solar farm tax revenue would be the KV School Corporation, Wolf said.

The fact that the school corporation is itself planning to lease land to Wabash Valley Energy Marketing, Inc., which supplies power to Jasper County REMC, was not discussed during the meeting.

Councilman Gerrit DeVries, a strong opponent to wind turbines in the county, asked about the science behind using batteries for storage of the solar power, which was part of the proposed solar farm. Wolf said the technology now is similar to that used for electric powered vehicles, but it is rapidly advancing. He said solar energy is not an all or nothing portion of electric generation. Utilities, like NIPSCO, need to diversify with wind, natural gas, solar and coal. Combined, Wolf explained, the utilities have a much larger advantage, especially during peak electrical demand periods. Solar is the cheapest option, he said, for utilities when electricity reaches its peak in the summer months, and that is the best time for solar to produce energy as well.